Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The difference will be the yield for the investor.

Solved Explain The Meaning Of All Of The Following Terms And Chegg Com

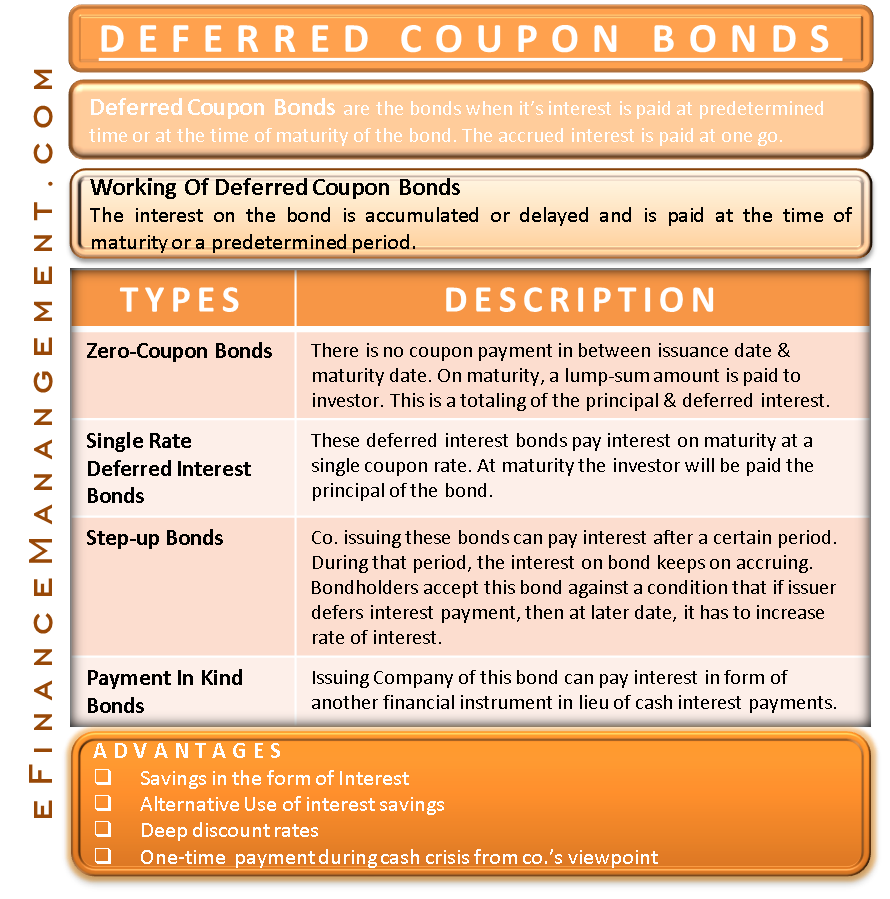

Deferred Coupon Bonds Definition How It Works Types Advantages

1

Bonds can be issued at a price lower.

Deep discount bonds meaning. Revenue bonds are typically non-recourse meaning that in the event of default the bond holder has no recourse to other governmental assets or revenues. If the going rate of interest for other bonds was 8 one would likely avoid this 5 bond or only buy it if it were issued at a deep discount. Long bonds could mean a world of pain and short bonds barely spike in a recession.

Even though there are sites like the Hidden Wiki and Tor links over 60 of the links there are long dead and those directories are seldom updated. About the register. This lets us find the most appropriate writer for any type of assignment.

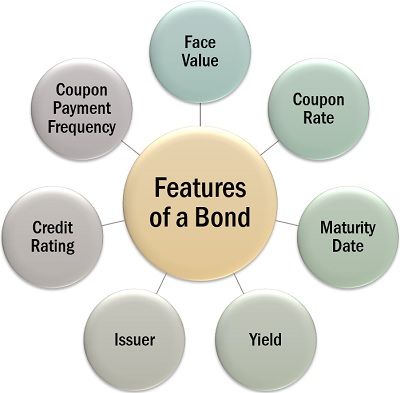

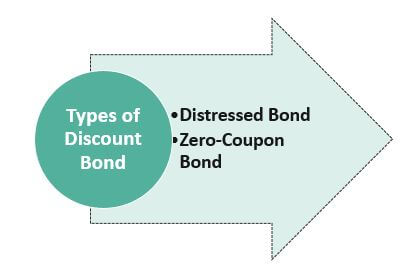

In any given year a stock can have steep highs and deep lows as its value is redefined again and again on the market making frequent buying. A zero-coupon bond also called a discount bond or deep discount bond is a bond bought at a price lower than its face value with the face value repaid at the time of maturity. When interest rates rise bond prices fall which results in a rise in yields of the older bonds and brings them into the same category as newer bonds being issued with higher coupons and vice-versa.

You can choose your academic level. An intermediate bond buffer should leave you with plenty of dry powder to buy cheap equities during the next crash. In fact on most days gold bonds sell at a discount to even IBJA gold price.

A few days have passed since his family was properly reunited and Shirou still doesnt know how to act. Everyone is acting normally or at least how they would have acted before Shirou became a more active member in the moonlit world. It is not that there is no yield.

Zero Coupon Bonds Explained With Examples - Fervent. Plus strengthen strands detangle reduce frizz and add shine with trial sizes of our Bond-Building Repair Shampoo and Conditioner. The Crystal Vaults Comprehensive Illustrated Guide to Crystals Your On-Line Guide to The Healing Energies Metaphysical Properties Legendary Uses and Meaning of Chrysocolla Shop for Chrysocolla Introduction to Meaning and Uses of Chrysocolla Chyrsocolla is first and foremost a Stone of Communication.

Long service leave and termination benefits. Paper Series EE bonds are issued at a discount. High school collegeuniversity masters or pHD and we will assign you a writer who can satisfactorily meet your professors expectations.

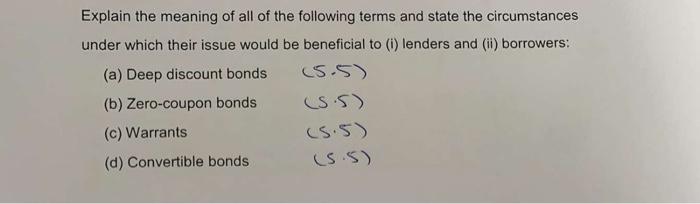

Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. The yield aka Yield to Maturity or the. The countrys 125-metre 410-foot deep Blue Hole is ranked as one the.

The further the deadline or the higher the number of pages you order the lower the price per page. Wages and salaries annual leave post-employment benefits such as retirement benefits other long-term benefits eg. There arent many places you can find over 191 deep web links on the web well thats exactly what we bring to you.

In Belizes case that discount was 45 while protecting the reef was economically as well as environmentally clear cut. Climate bond is a bond issued by a government or corporate entity in order to raise finance for climate change mitigation- or. Usually for retirement purposes.

We know that IBJA gold does not offer any interest. The standard establishes the principle that the cost of providing employee benefits should be recognised in the period in which. Therefore the value of the bond the sum of the present value of all future payments hence it is the present value of an annuity which is a series of periodic paymentsThe present value is calculated using the prevailing market interest rate for the term and risk profile of the bond which may.

CODES Just Now Zero Coupon Bond Example Valuation Swindon Plc Consider an example of Swindon PLC which is issuing a zero coupon bond with a par value of 100 to be paid in one years time. 21- Fathers and Sons. The zero coupon bonds are issued at a price lower than the face value say 950 and then pay the face value on maturity 1000.

IAS 19 outlines the accounting requirements for employee benefits including short-term benefits eg. On the other hand the 5 rate might look pretty good if the going rate was 3 for other similar bonds in which case one might actually pay a premium to get the bond. These are also called as discount bonds or deep discount bonds if they are for longer tenor.

We dont juggle when it comes to pricing. The original 10-year maturity period of Series E bonds has been extended to 40 years for bonds issued before December 1965 and 30 years for bonds issued after November 1965. Inflation-indexed bonds also known as inflation-linked bonds or colloquially as linkers are bonds where the principal is indexed to inflation.

Some bonds are inflation-indexed meaning the face value is. Despite this gold bonds trade at a discount. Our powerhouse Bond-Building Repair Treatment goes deep to help reverse the look of past damage as well as fortify hair fibers to protect against future damage.

Corporate Bonds have subtypes depending on additional features like Callable Bonds Convertible Bonds Deep- Discount -Bonds and Zero-Coupon bonds. In other words. These bonds are often sold at a discount and have a fixed interest rate that only pays out upon bond maturity.

Hence as a buyer you can get a good deal. SGBs offer interest income. Before July 1980 Series E bonds were issued.

A 5 to 10 slug in cash and gold further diversifies your defences in a downturn. So bonds with low ratings called junk bonds are sold at lower prices and those with higher ratings called investment-grade bonds are sold at higher prices. Its very essence is devoted to expression empowerment and teaching.

We always make sure that writers follow all your instructions precisely. So weve compiled this list of 191 working deep web links which weve manually tested and verified to be functional. In finance a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed price called exercise price until the expiration date.

A corporate bond is issued by a corporate-like it issues shares and has a higher yield than government bonds as they are riskier. Here we have a par value of 100 pounds. This site implements the register of Regulation EU No 2362012 Short Selling Regulation SSR with regards to shares sovereign bonds and credit default swaps for which The Financial Supervisory Authority of Norway Finanstilsynet.

A zero-coupon bond is a debt security that doesnt pay interest but trades at a deep discount rendering profit at. Both are discretionary and have expiration dates. Different issues have varying liquidity.

What is the price of this bond today if the yield is 7. Meaning the investor would receive. A bond pays interest either periodically or in the case of zero coupon bonds at maturity.

A zero-coupon bond is a debt security that doesnt pay interest but trades at a deep discount rendering profit at maturity.

Deep Discount Bond Or Zero Coupon Bond Commerceangadi Com

What Is A Zero Coupon Bond Definition Features Advantages Calculation Example Limitations Treatment Of Income The Investors Book

Pros And Cons To Zeros Vs Coupon Bonds 11 2021

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Bond Definition

Deep Discount Bond Definition Example Investinganswers

Deep Discount Bonds Financiopedia

Types Of Bonds Boundless Finance

Discount Bond Definition Examples Top 2 Types Of Discount Bonds