Based on the above formula an increase in stock prices will cause total market. Market cap is also incorrectly known as what the company is really worth.

What Is Market Cap Definition Use Speck Company

Market Capitalization Formula And Calculation Of Equity Value Wall Street Prep

Market Capitalization Concept Formula Types Pros Cons More

Trust Score is used to measure liquidity on trading pairs and on crypto exchanges it is expanded to also measure overall liquidity scale of operations and API coverage.

Market capitalization formula. The market cap is a more suitable instrument for this. Market capitalization is about the price of a company. Market cap is calculated by multiplying the stock price by the number of shares outstanding.

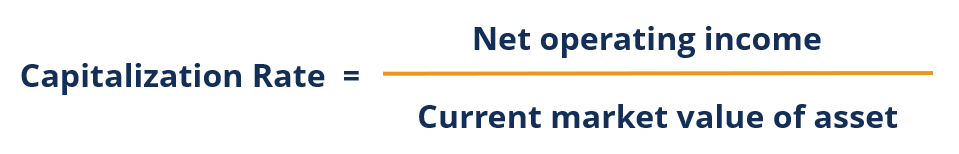

The per share price of a company x the total number of shares of that company Market Capitalization. The greater a companys market capitalization the greater the weight it carries in the composition of the index. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset.

The market cap formula is simply this. The cheapness factor is represented by the earnings yield EY and measured by calculating the ratio of pretax earnings EBT to market capitalization. MC N X P.

Volume is the total trading volume of a cryptoasset across all active cryptoasset exchanges tracked by CoinGecko. The market capitalization of each company is the product of its issued shares and its market price. The capitalization rate can be used to determine the riskiness of an investment opportunity a high capitalization rate implies higher risk while a low capitalization rate implies lower risk.

One such instance is when employees have stock options. But many companies find themselves in a situation where the number of outstanding shares could suddenly rise. Many beginners make the mistake to only look at the unit price of a coin to decide if the coin in question is worth much or little.

Market cap is computed using the formula. Joel Greenblatts original formula excluded financial companies. How to calculate market cap.

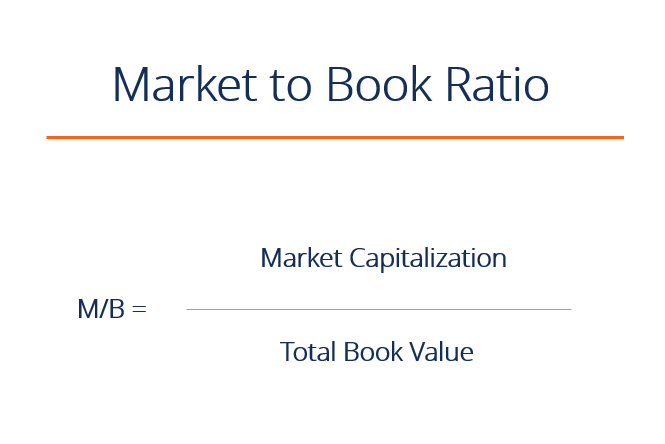

You might also be trying to find a market-based cap rate using recent sales of comparable properties. Market to Book Ratio Market Capitalization Book Value. The Capitalization-Weighted Index cap-weighted index CWI is a type of stock market index in which each component of the index is weighted relative to its total market capitalization.

The formula to calculate the market to book ratio is very simple. Dividend Yield Investors check both the price and dividend earnings from a share so this ratio helps in measuring the amount of dividend distributed in a year against the number of shares outstanding. In other words it is the market capitalization for a given company at a.

In a capitalization-weighted index companies with larger market capitalization exert a greater impact on the index value. Market Capitalization Market Cap The market cap shows the total value of all coins together. This is a change of 691 from last month and 4417 from one year ago.

Market to Book Ratio Formula. The formula to compute the index is as follows. Market Capitalization of VIP Industries is INR 713652 Cr.

Market Capitalization Formula Example 2. The market capitalization formula gives us the total value of the company. This is higher than the long term average of 8757.

To calculate a companys market cap multiply the number of shares outstanding by the current price of a single share. You divide a companys market capitalization by its book value. Find out the Number of Shares trading in the Stock exchange.

For example if a company has 4 million shares outstanding and the closing price per share is 20 its market capitalization is then 80 million. The band of investment formula is simply a weighted average of. I want to be very clear about this.

The market capitalization Formula is the main component when we want to assess a stock because we can calculate the value of the company from it. One of the major factors while evaluating a stock is on the basis of the market capitalization in India. US Total Market Capitalization is at 2102 compared to 2101 the previous market day and 1751 last year.

Market Capitalization Number of Outstanding Shares X Price Per Share. Market capitalization or market cap is a simple metric based on stock price. The market capitalization Formula allows us to.

It is a parameter for determining the size of a firm based upon its market value. Market Value is the total value of the shares outstanding in the market. Market Capitalization is calculated by multiplying Coin Price with Available Supply.

SP 500 Market Cap is at a current level of 3906T up from 3654T last month and up from 2710T one year ago. Market capitalization is a corporate valuation of a company in terms of market price of outstanding shares. Market capitalization refers to the market value of a companys equity.

Thus Market Value or the trading price could suggest the total market capitalization of the company or vice versa. How to calculate the market to book ratio. Capitalization rate or cap rate is a real estate valuation measure used to compare different real estate investmentsAlthough there are many variations the cap rate is generally calculated as the ratio between the annual rental income produced by a real estate asset to its current market valueMost variations depended on the definition of the annual rental income and whether it is gross.

The basic market capitalization formula multiplies the companys market price by the number of outstanding shares. It is a simple but important measure that is calculated by multiplying a companys shares outstanding by its price per. Market cap is given by the formula where MC is the market capitalization N is the number of shares outstanding and P is the market price per share.

With some imagination we used the principles of the original Magic Formula and created a Magic Formula Screener for Banks. The capitalization rate is a fundamental concept in the commercial real estate industry. Where MC stands for Market Capital N for the number of outstanding shares.

Before going into the finer nuances knowing the formula for this evaluation method can provide clarity to investors.

Market To Book Ratio Price To Book Formula Examples Interpretation

Pj Liwzjbhtucm

Market Capitalization Definition What Is Market Cap Roovestor

This Is Market Cap Live Trading News

What Does A Company S Market Capitalization Represent Quora

Market Capitalization Calculator

424b2 1 Dp72384 424b2 Insupp Htm Form 424b2 Index

Capitalization Rate Overview Example How To Calculate Cap Rate