Where a cheque is originally expressed to. We work with international partners and other countries to tackle global challenges increase trade and investment opportunities protect international rules keep our region stable and help Australians.

Accounts Payable Explanation Accountingcoach

Accounts Payable Meaning Process Formula Journal Entries

Difference Between Accounts Receivable And Accounts Payable With Comparison Chart Key Differences

While issuing debentures help a company trade on equity it also makes it to dependent on debt.

Trade payable meaning. Bankers Automated Clearing Services. Vouchered or vouched means that an invoice is approved for payment and has been recorded in the General Ledger or AP subledger as an outstanding or open liability because it has not been paid. Under this LC documents are payable at the sight upon presentation of the correct documentation.

Such a bond is in essence is. Payment of cheque payable to order. Payables are often categorized as Trade Payables payables for the purchase.

Accounts payable is similar to accounts. This prerequisite generally comes from the definition of trade secret as found either in the relevant statute which typically will be a variation of the Uniform Trade Secrets Act or section 757 of the Restatement of Torts. A good credit score can go a long way in maintaining good relationships with creditors and bankers.

Buyers are hesitant to place fresh orders meaning theres been a swift. It is a liability that appears on the companys balance sheet. Trade working capital is the difference between current assets and current liabilities directly.

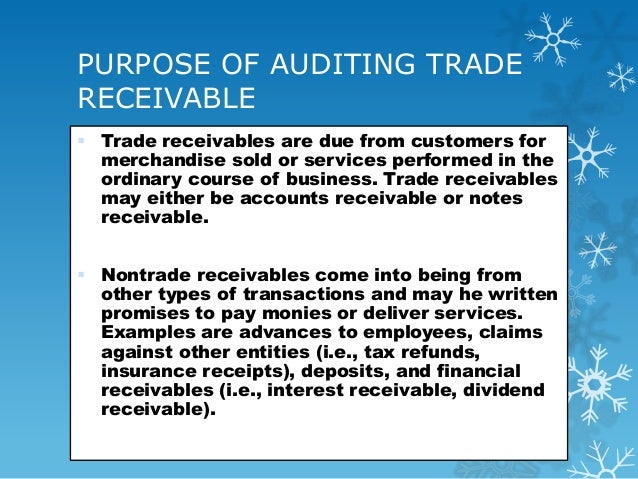

Can take up to three working days to clear. Since the financial crisis trade credit in the form of accounts payable and accounts receivable has become a stable source of finance. Payable out of Profits Only.

A skewed Debt-Equity Ratio is not good for the financial health of a company. Tax collected at source TCS is the tax payable by a seller which he collects from the buyer at the time of sale. 40011b2 to a CBP port of entry operated as a public utility within the meaning of Sec.

Other than those payable by the seller. To unsatisfied buyers dramatically impacting their confidence in suppliers. Read more to these holders is called a cost of debt Cost Of Debt Cost of debt is the expected rate of return for the debt holder and is usually calculated as the effective interest rate applicable to a firms liability.

Where a cheque payable to order purports to be indorsed by or on behalf of the payee the drawee is discharged by payment in due course Payment of cheque payable to bearer. Amounts owed to another person or business eg accounts payable Equity. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers.

Businesses regardless of the industry or size require regular cash flow from their clients and the customer to pay their expenses such as their employees salaries and the utilities. World trade is in for a reality check as the huge spike since the. A debit is an entry made on the left side of an account.

FOB Free on Board is the most commonly-used trade term but in practice it is used without reference to any version of the Incoterms rules. If there is no profit there can be no distribution of dividend. For example a businessman can present a bill of exchange to a lender along with a sight letter of credit and take the necessary funds right away.

Debits increase an asset or expense account or decrease equity liability or revenue accounts. According to the Negotiable Instruments Act 1881 a bill of exchange is defined as an instrument in writing containing an unconditional order signed by the maker directing a certain person to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument. Interest payable Interest Payable Interest Payable is the amount of expense that has been incurred but not yet paid.

B If Supplier the goods and services provided to Buyer or the use thereof by Buyer infringes on any partys intellectual property rights including any partys confidential information trade secrets copyrights or patents the sale or use of such goods or services is enjoined Supplier shall at its expense and option either procure for Buyer the right to continue to use such goods or. Out of the profits of the Current financial year or. This is because you can get loans and trade credit on attractive terms from bankers and creditors.

Thats why invoicing and knowing invoicing terms is a necessityWithout these bills you wont be compensated for the services rendered or products sold which in turn means that you wont be able to. Foreign-Trade Zone - FTZ or zone includes one or more restricted-access sites including subzones in or adjacent as defined by Sec. Take Benefit of Accounts Payable.

It is payable even in the event of a loss. Only the persons you nominate in Schedule 2 as Authorised Users can access the Employment Law Advice. A sight letter of credit is more immediate than other forms of letters of credit.

GSTGoods and Services Tax is payable in relation to each taxable supply under this Agreement. It is especially important when firms find it challenging to obtain funding via financial or credit institutions. Cash earned from sales.

These Agreements cover goods services intellectual property standards investment and other issues that impact the flow of trade. The interest payable to debenture holders is a financial burden for the company. 40042 under the sponsorship of a zone grantee authorized by the Board with zone operations under the supervision of CBP.

Section 85 2 of the Act states that. Tradeshift is a market leader in e-invoicing and accounts payable automation and. GST taxable supply and tax invoice have the meaning given in the A New Tax System Goods Services Tax Act 1999.

The Companies Act provides that a dividend can be paid only. Payment of a bill. Trade credit is an essential source of finance for small businesses.

The World Trade Organization WTO Agreements create an international trade legal framework for 164 economies around the world. Department of Foreign Affairs and Trade The Department of Foreign Affairs and Trade DFAT promotes and protects Australias international interests to support our security and prosperity. Section 85 1 of the Act states that.

In other words dividend is payable only out of profits. Accounts payable are considered a source of cash meaning that by taking advantage of these arrangements with suppliers a company can actually increase its cash flow and cash on hand. Meaning of Bill of Exchange.

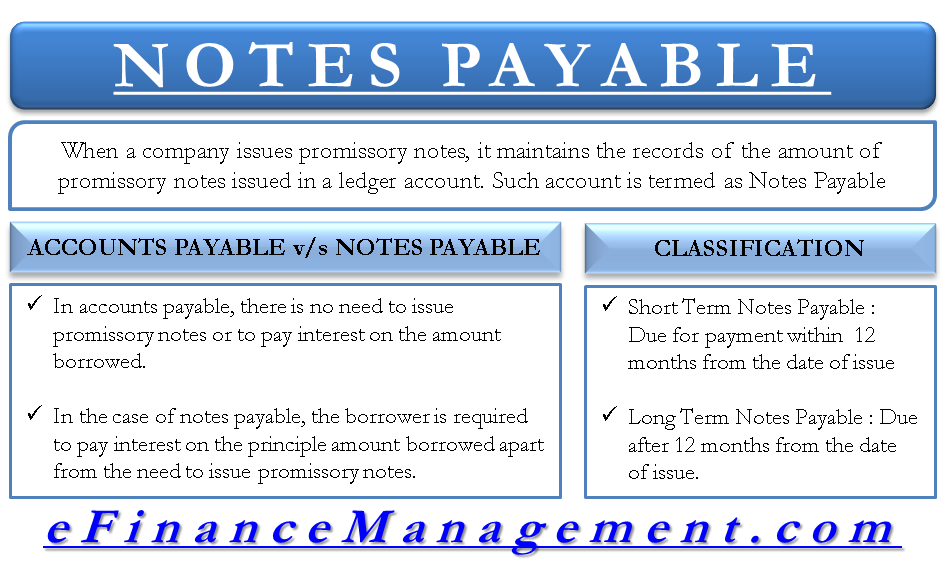

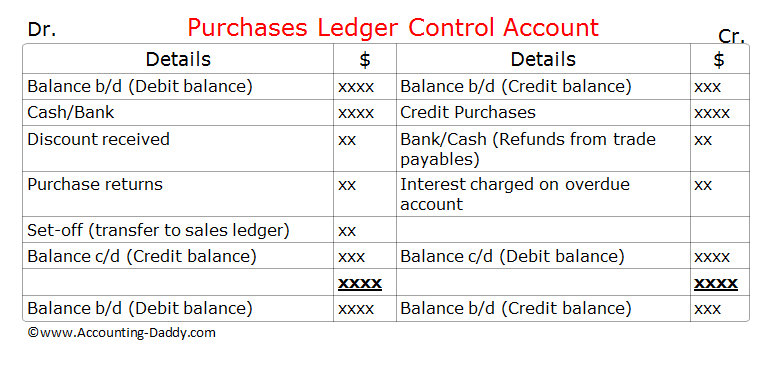

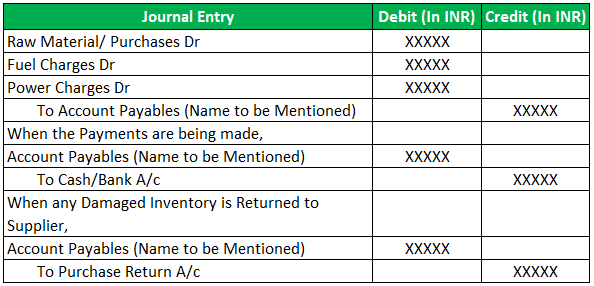

Bills Payable Meaning Prepaid expenses refer to advance payments for business expenses while debts owed by a company in the course of its trade are called accounts payable. A rate of interest payable over a year. An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouched for payment.

The company can declare and pay a dividend only where there is a profit. The deposit of cash or a cheque in a bank branch. Meaning alongside the vessel for FAS and loaded on board the vessel for FOB.

Meaning the account balance is due from the debtor. Comparative Balance Sheet Meaning. Electronic system to make payments directly from one account to another.

Your assets minus your liabilities. The comparative balance sheet is a balance sheet which provides financial figures of Assets Liability and equity for the two or more period of the same company or two or more than two company of same industry or two or more subsidiaries of same company at the same page format so that this can be easily understandable and easy to analysis.

Notes Payable Definition Classification Vs Accounts Payable Example Efinancemanagement Com

Purchases Ledger Control Account

What Is Accounts Payable What Does Accounts Payable Mean Accounts Payable Meaning Explanation Youtube

Trade Receivable And Trade Payable

Accounts Payable Examples Full List With Explanation

1

Trade Payables And Trade Receivables Chapter 9 Contents Recognition Measurement And Derecognition Discounts Payables Reconciliation Doubtful Debts Impairments Ppt Download

How Do Accounts Payable Show On The Balance Sheet