Signage illuminated at the China Huarong Asset Management Co. Markets Stocks Indices Commodities Cryptocurrencies Currencies ETFs News Economic.

Breaking Down China Huarong S Debt Case What It Means For China S Bond Market Pinebridge Investments

Exclusive Huarong Gets Top Rating On Bond Sale Despite Scandals Profit Slump Caixin Global

China Huarong Bond Panic Eases After Government Breaks Silence

BEIJING Reuters China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re-focus on its main bad loan business.

Huarong finance bond. Beijing-based Huarong is accelerating the sale of non-main business assets Yicai Global learned and has CNY125 billion of bonds due on Nov. China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re. The company operates the BondbloX Bond Exchange BBX the worlds first fractional bond exchangeRegulated as a Recognised Market Operator by the Monetary Authority of Singapore BBX transforms the bond market globally by enabling investors to conduct electronic bond trading of fractional bonds BondbloX.

You need to be a subscriber to view this content. Huarong one of the four state distressed debt managers and counts Chinas finance ministry as its largest shareholder had missed a March deadline for filing its 2020 earnings sparking a. Bonds search and comparison.

Headquarters on Financial Street in Beijing China on Wednesday May 19 2021. Beijing aced its economic recovery from the pandemic largely via an expansion in credit and a state-aided construction boom that sucked in raw materials from across the planet. Huarong reported a net loss of 1029 billion yuan in 2020 and had borrowings of 782 billion yuan at the end of June this year with 578 billion yuan of the total coming due within a year.

Huarong gets approval to raise 11 billion bond in interbank market BEIJING Reuters China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re-focus on its main bad loan business. Huarong intends to issue a maximum of 3922 billion domestic shares and not more than 196 billion shares listed on the Hong Kong exchange to a consortium of investors including Citic Group China Cinda Asset Management and China Life Insurance among others. Huarong one of the four state distressed debt managers and counts Chinas finance ministry as its largest shareholder had missed a March deadline for filing its 2020 earnings sparking a.

7 Year Treasury Note news historical stock charts analyst ratings financials and todays stock price from WSJ. Subsequent issuances from repeat issuers are not included here. Market Insider is a news aggregator for traders and investors that proposes to you the latest financial news business top stories todays headlines and trading analysis on stock market currencies Forex cryptocurrency commodities futures ETFs funds bonds rates and much more.

Are also expected to inject cash into the stricken conglomerate. China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re. The Ministry of Finance of the Peoples Republic of China Chinese.

China Huarong Gets Nod to Raise USD11 Billion in Bond Sale Qi Ning 2 Gree Electric Buys Major Stake in Parts Maker Dunan to Boost Diversification Wang Zhen. Group ltd yanlord land group ltd yanlord land hk co ltd pingan real estate capital ltd fuqing investment management ltd huarong finance 2019 co ltd car inc china fortune land development co ltd cfld cayman. Bond is an investment product.

BondEvalue is a Singapore-based fintech that specializes in bond market technology. New Issuers This database provides an overview of new green bond issuers entering the market. Strategic investors brought in as part of the rescue plan which is being spearheaded by state-owned heavyweight Citic Group Corp.

The bond sale was approved by Huarongs shareholders in October part of a package of measures to raise capital and sell assets to pay down debt and strengthen the companys balance sheet. Following a huge bribery and corruption case involving former Chairman Lai Xiaomin who was executed in January Huarongs hidden asset risks gradually came to light. The bond sale was part of a package of measures to raise capital and sell assets to pay down the companys debt and strengthen its balance sheet.

While majority owned by the Chinese Finance Ministry since 2014 it has sold shares to others including Goldman Sachs and Warburg Pincus. Huarong is one of four such state-owned companies created in the wake of the 1998 Asia financial crisis to manage assets of bankrupt state companies. TMUBMUSD07Y View the latest US.

It is of the view that the Issuance is the only practical measure to solve the capital insufficiency difficulty of the company and. Finance The White Knights Bailing Out Chinas Distressed Companies Arent Generous Huarong and Tsinghua Unigroup seem to be benefiting from. With the bond screener you can choose from all bonds traded worldwide according to all important criteria.

SP 500 -202. Zhōnghuá Rénmín Gònghéguó Cáizhèngbù is the cabinet-level executive department of the State Council which administers macroeconomic policies and the annual budgetIt also handles fiscal policy economic regulations and government expenditure for the state. China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re.

Issuers who issued for the first time before 2018 are gradually being entered. Huarong gets approval to raise 11 bln bond in interbank market November 16 2021 BEIJING Nov 16 Reuters China Huarong Asset Management has been granted approval to raise 70 billion yuan 11 billion of financial bonds in the interbank market as it continues to improve its credit profile and re-focus on its main bad loan business. Huarong one of the four state distressed debt managers and counts Chinas finance ministry as its largest shareholder had missed a March deadline for filing its 2020 earnings sparking a.

Huarong Trouble Shows Need For Better Credit Gauges Asia Times

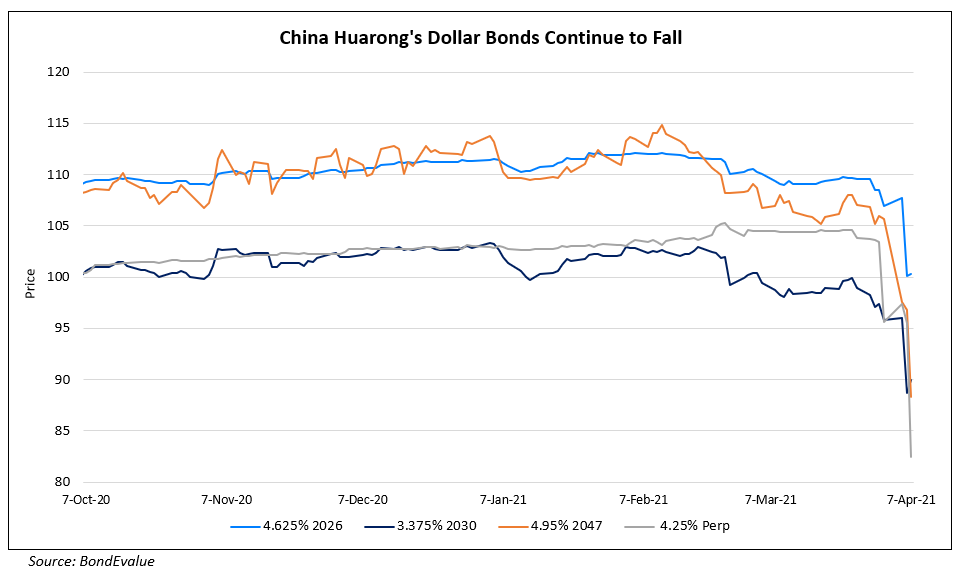

Investors Continue To Dump Huarong Bonds On Reports Of Restructuring Track Live Bond Prices Online With Bondevalue App China Huarong Asset Management Or China Huarong China Huarong Huarong Finance

China Huarong Uncertainty Unnerves Debt Investors As Credit Ratings Agencies Review Outlook For Distressed Debt Manager South China Morning Post

Will Chinese Overseas Bond Issues Be Imperilled By Concerns Over Huarong Asset Management China Banking News

Exclusive China Pushes Huarong To Sell Non Core Units Mulls Implicit Support Sources Reuters

Huarong S Bonds Slip After Delay In Earnings Release Share Trading Halt Track Live Bond Prices Online With Bondevalue App China Huarong Asset Management Or China Huarong China Huarong Huarong Finance

1

Chinese Ratings Group Cuts Huarong Outlook To Negative As Bonds Slide Financial Times